The “buy now pay later” model has become popular in the world of eCommerce. Even giants such as PayPal have invested in this model. As a result, most established retailers in Australia are either already set-up or considering the model as an option for their businesses.

While the model has its benefits, it does not come without some risk. Not only that, but not all lay-buy services are created equal.

AfterPay and ZipPay, for example, are two major players in lay-buy services in Australia. Though they essentially provide the same services, they differ greatly from one another. These differences can be significant enough to affect your business’s bottom line.

How, then, should you choose between the two? What do you need to know about these services before you make your choice?

Continue reading in order to find out how AfterPay and ZipPay measure up to each other.

Costs For Retailer

There is a cost to implementing one of these “buy now pay later” models for your business. The service providers do, after all, have to make a profit. The service provider you choose will determine just how high your costs are.

That said, let’s take a look at the costs of using AfterPay and ZipPay.

AfterPay

AfterPay is the more expensive lay-buy service of the two we’re highlighting here. Merchants are charged 30 cents plus commission for every transaction they make via AfterPay. The commission ranges from 4 to 6 percent.

Although AfterPay is a lay-buy service, merchants receive immediate payment minus the commission and flat fee of 30 cents.

Unfortunately, though, this “immediate” payment is not so immediate. The company can take up to 48 hours to compensate the merchant for the transaction.

ZipPay

ZipPay is a cheaper alternative to AfterPay. Merchants who use ZipPay pay 15 cents plus commission for every transaction that is made via the lay-buy service. This commission ranges from 2 to 4 percent.

As you can see, ZipPay’s upper limit on commission is equal to AfterPay’s lower limit. Even if you pay the upper limit, however, you still save 15 cents on every transaction.

Like AfterPay, ZipPay compensates retailers immediately despite offering lay-buy services. This time around, the term “immediately” is apter. Merchants receive payment every day at four o’clock in the afternoon.

AfterPay |

ZipPay |

|

|---|---|---|

| Cost | 30 cents per transaction plus commission. | 15 cents per transaction plus commission. |

| Commission | Ranges from 4 to 6 percent. | Ranges from 2 to 4 percent. |

| Merchant payment | Merchants receive payment up to 48hrs after the transaction. | Merchants receive payment every day at 4pm. |

Despite its lower cost, you might not want to jump the gun on ZipPay. As you’ll see later, it doesn’t beat AfterPay out in every category.

Compatibility

Sometimes a retailer’s decision to choose one service over another has little to do with cost. A merchant’s ability to integrate a service into its platform becomes a primary issue on some occasions.

When choosing between AfterPay and ZipPay, you might run into this problem as well. Having said as much, we’ll be taking a look at how compatible these lay-buy services are with certain platforms.

AfterPay

AfterPay may be the more expensive of two, but it plays well with a number of platforms. The site boasts “instant integration” with Magento, WooCommerce, Neto, Shopify, Island Pacific, Infinity, Futura4Retail, and Commerce Vision.

Furthermore, AfterPay offers “comprehensive technical support for initial integrations and ongoing maintenance whenever you need it.”

At Digital Outlook, we’ve integrated a number of Magento sites with AfterPay. While the integration isn’t entirely instant, most of the core functions do work out-of-the-box, however some customisation is needed to match the styles of your website 100% and to resolve any conflicts in the checkout. AfterPay’s integration steps are very clear and their technical support is excellent to help with the set-up.

ZipPay

We can sometimes predict that a cheaper service will provide less convenience in some ways. In the case of our cheaper “buy now pay later” platform, this happens to be true.

ZipPay is compatible with Shopify, WooCommerce, Magento, BigCommerce, and Neto. The service definitely gives ZipPay a lot less to work with in this area.

Even so, ZipPay is willing to work with you if you don’t have the right platform. The company encourages retailers to contact its team of “dedicated integration specialists.”

Of course, there is no guarantee that these specialists will be able to help you in every situation. Still, why not try if you’re passionate about using ZipPay?

Built-In Risk Assessment

Many of you have probably been dying to find out just how risky doing business with a lay-buy provider is. After all, customers pay for the products in instalments whilst you receive all of the money for the transaction almost immediately.

How protected are you as a merchant when customers fail to make their payments? Let’s have a look.

AfterPay

Simply stated, there is no risk to using AfterPay. Once a transaction has been completed, the customers are out of your hands. You receive your money and fork over the commission and flat fee of 30 cents.

The customers are then left to deal with AfterPay. They make all of their payments to the lay-buy provider according to the terms both parties agreed upon. If the customers fail to pay, you are not held responsible in any way.

ZipPay

ZipPay, like AfterPay, is free of risk for merchants. Customers make transactions, you receive your money and pay the agreed upon amount, and the customers deal with ZipPay from thereon out.

Customer Appeal

Thus far, we’ve only discussed how doing business with these two companies will directly and immediately affect merchants. Now, though, we must consider how the lay-buy service you choose will affect your customers and their perception of your business. As you’ll see from the examples below, the two platforms vary greatly in the way that they approach the instalments and what the customer is able to do.

AfterPay

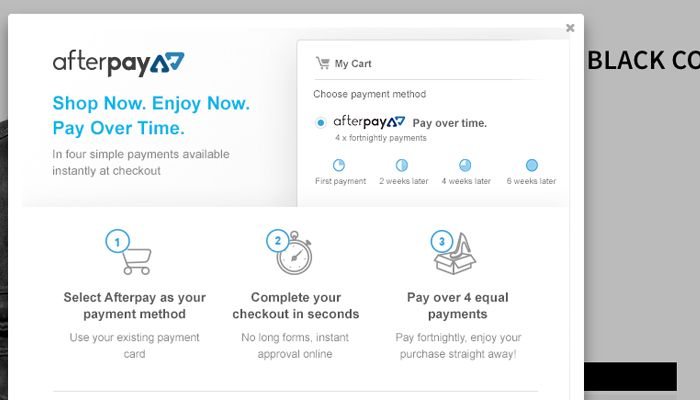

AfterPay functions a bit like a credit line for customers. They can use it to buy products and pay the money back later.

To create an account all you have to do is provide a valid email, phone number, DOB and postal address. Once your account is created you just enter your credit card details and you’re off!

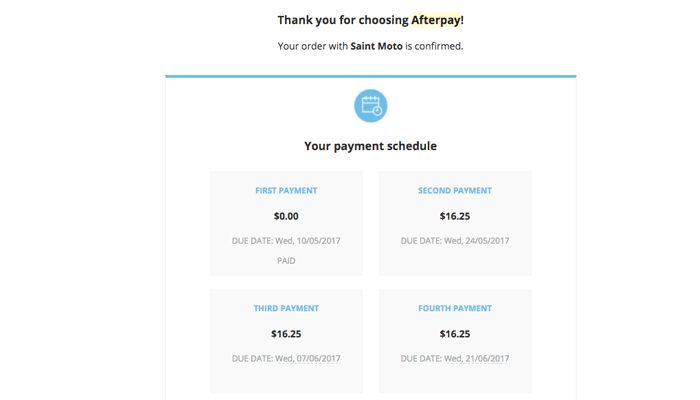

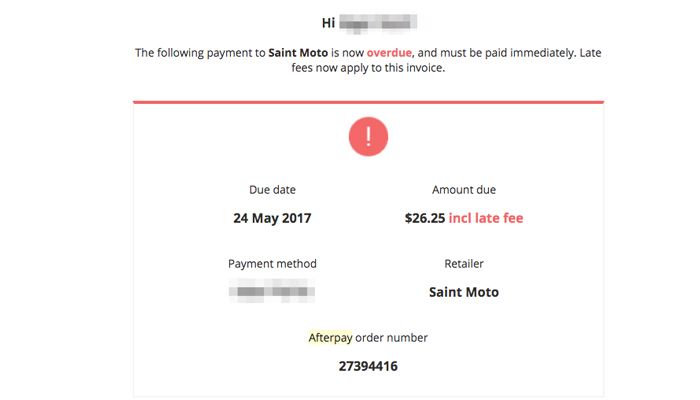

A customer doesn’t have any flexibility to change the instalment schedule at all, with the 4 payments being made over an 8 week period. The first instalment is taken on the initial purchase and if they fail to make a payment for any reason, they are charged a late fee.

Needless to say, AfterPay isn’t ideal for customers who need a bit more time to pay back any borrowed money or want the flexibility to decide when their instalments are made and what amounts to pay off.

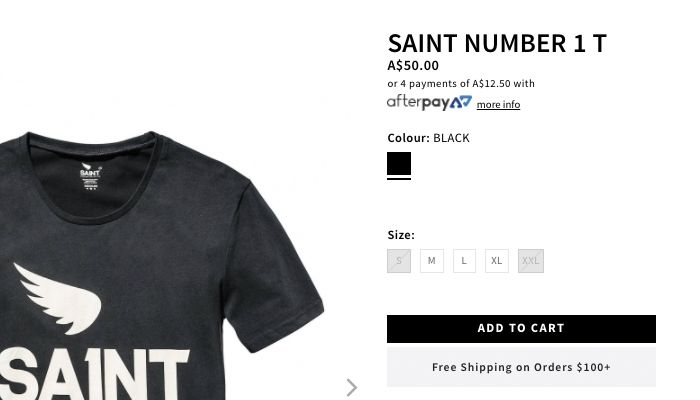

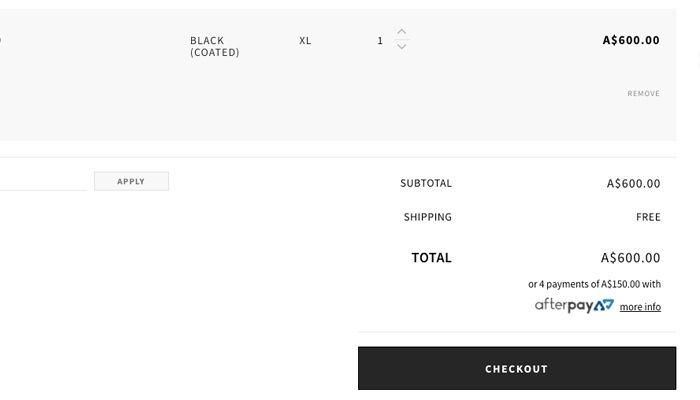

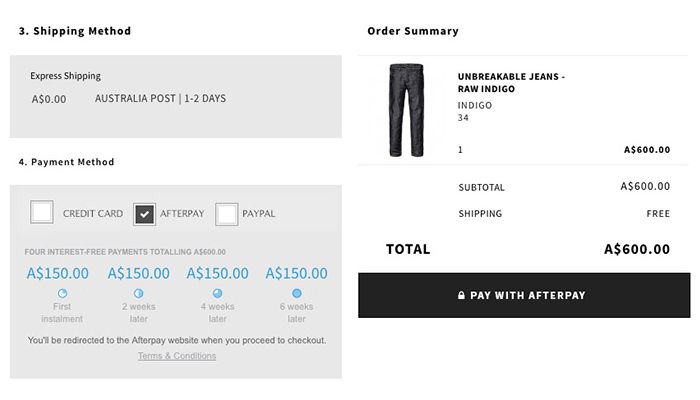

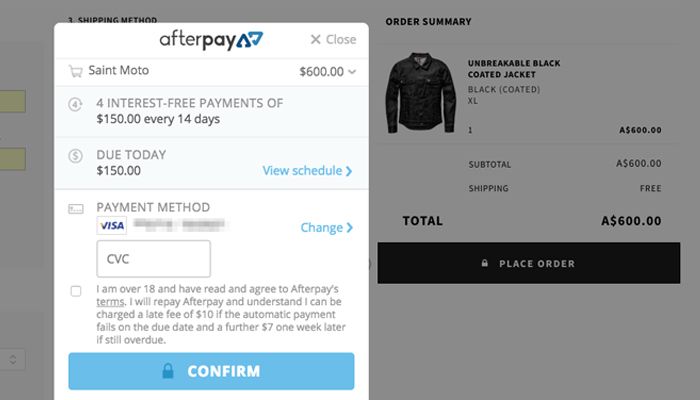

We’ve captured the main steps when using AfterPay for one of our clients (SA1NT) so you can see the workflow. One of the main advantages of AfterPay over ZipPay is that the instalment amounts are clearly indicated on key pages, such as the product detail, cart and in the checkout. This makes it clear to the customer what they’re committing to up-front and the number of repayments. There’s also little need to log into the AfterPay user account after making the purchase as the debits and schedule are already locked in.

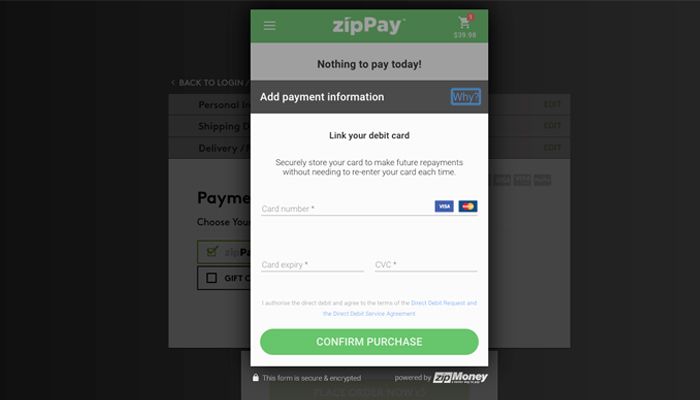

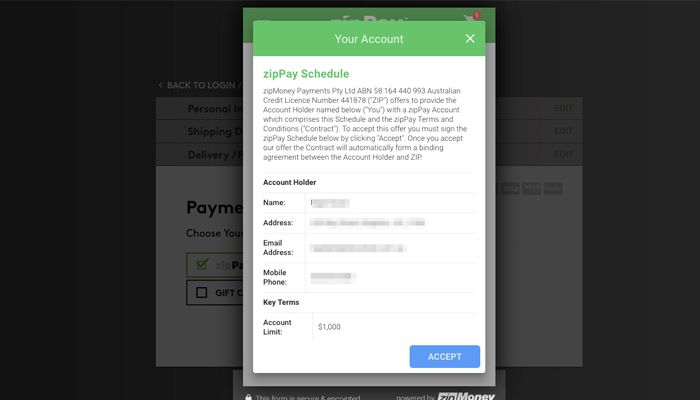

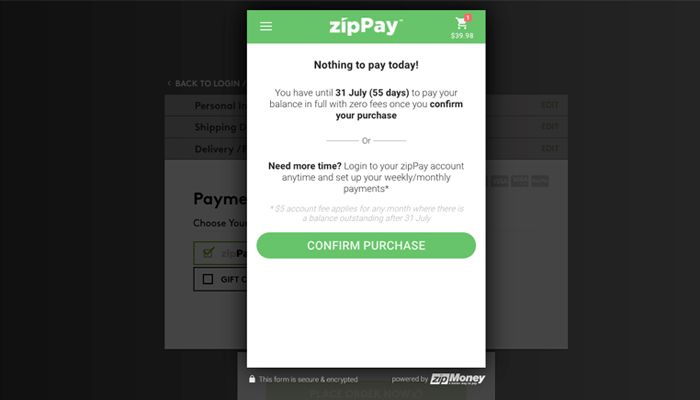

ZipPay

ZipPay gives customers a credit line of up to $1,000 dollars. Unlike AfterPay, ZipPay allows customers much more time to pay back what they’ve borrowed. The payment schedule is also more flexible, ranging from weekly to monthly.

If customers have an outstanding balance at the end of the month, they must pay a $5 service fee. They must also pay back at least $40 dollars each month.

ZipPay is a good bet for those customers who will need more time to gather up the money for their purchases.

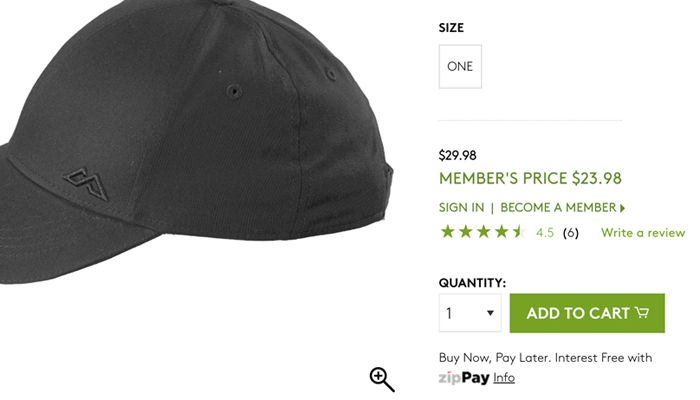

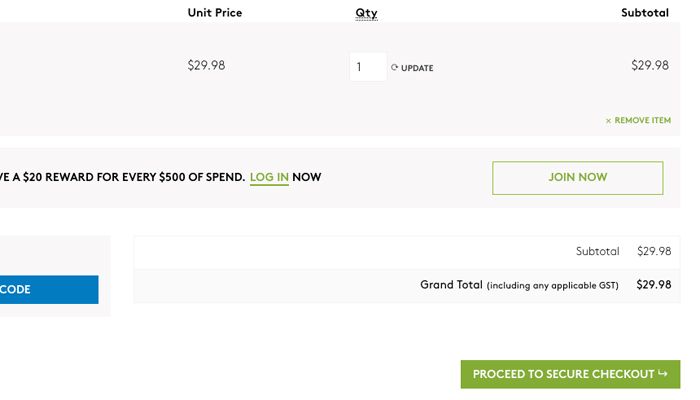

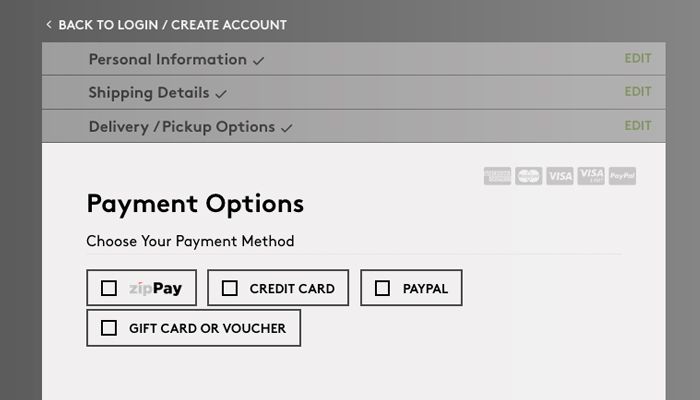

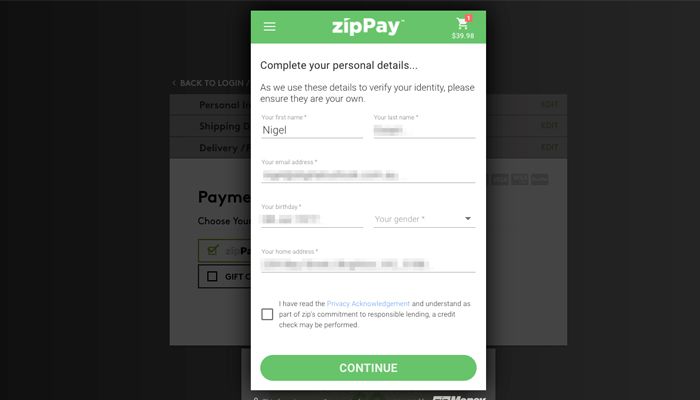

As mentioned above, because the instalment schedule can be decided by the customer, there is no mention of the instalment amounts with ZipPay. While this provides greater flexibility for the customer, it’s not as obvious how the payments will work, which may impact conversion rates. One thing we were impressed with when creating an account, is the ability to login or create an account with your Facebook or LinkedIn credentials. These screengrabs are from the Katmandu website.

One thing we found surprising is that neither platform allows you to use an Amex credit card as your payment method, with only Visa and Mastercard accepted.

Choosing The Right Buy Now Pay Later Service

Ultimately, the lay-buy service you choose has to fit into your business model. You must take both your needs and your customers’ needs into consideration before choosing.

While AfterPay and ZipPay differ in the way that customers’ manage their repayments, we don’t believe an online store will miss out on a sale because they don’t offer the alternative. It would be more damaging for a retailer to not offer any sort of “buy now pay later” method at all.

That said, AfterPay is the more popular of the two with the major online retailers so there will be some advantage as customers’ would have had more exposure to the brand and will be more likely to have an existing account. We also like how AfterPay clearly indicates the instalment amounts and number of payments, which makes it easier for them to understand their commitment.

Depending on the set-up of your business, another important consideration should be what these companies are offering in terms of in-store capabilities. In the ideal world, customers should be able to use the one account for lay-buy purchases online and offline. Out of these two providers, ZipPay appears to have a more comprehensive offering, supporting POS support for systems such as Magenta, FBS and Advanced Retail. You can read more here.

There are also now a number of other players in the market, so if you’re shopping around be sure to check out Zumi and OpenPay.

DIY “Buy Now Pay Later”

If you want to go it alone and create your own “buy now pay later” functionality, this is also an option. This means you will carry the risk if customers cancel their cards or run out of credit, however it also removes the middleman and any fees you have to pay.

At Digital Outlook we’ve created a custom module for the retailer Shop Solutions, which has been branded as EasyPay. The main reason for creating their own lay-buy payment system was to match the instalment workflow and branding from their printed catalogues, which are sent to millions of customers each year.

Shop Solutions can configure the number of instalments and amounts on a per product basis, with the original pre-authorisation and instalment debits charged automatically via their payment gateway, eWay. All the standard system emails have also been set-up to notify customers of successful and failed debits automatically.